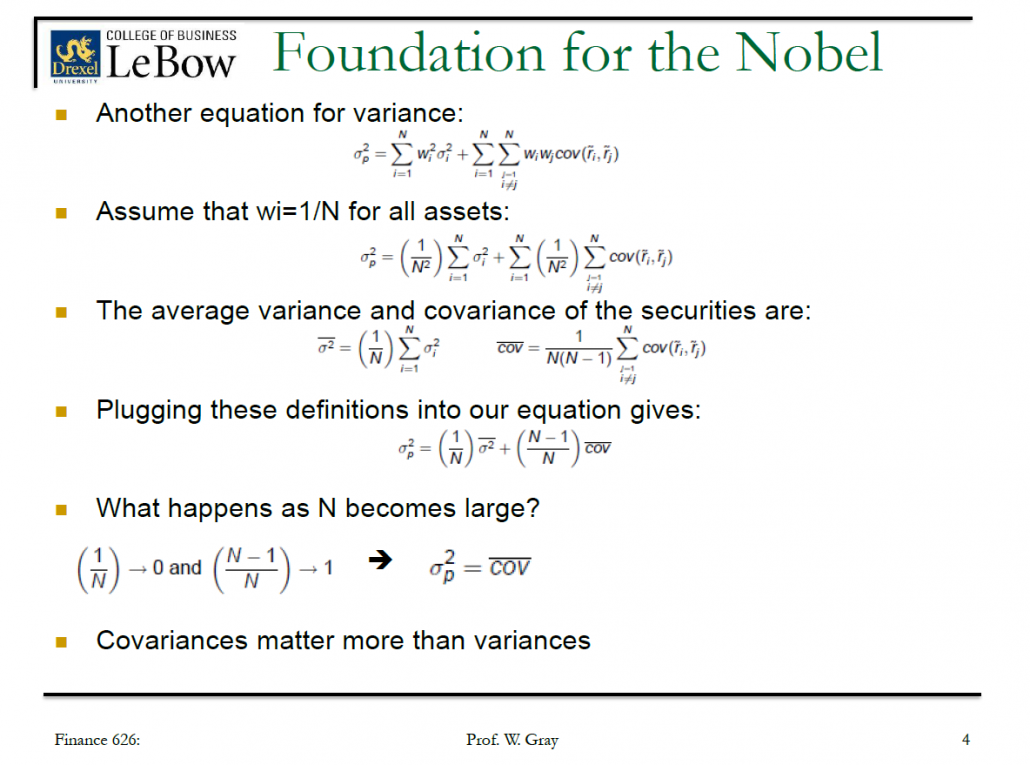

Portfolio diversification formula

Replacing the formula for. Real estate investments can add diversification to your portfolio and getting into the market can be as easy as buying a mutual fund.

Tactical Asset Allocation Beware Of Geeks Bearing Formulas

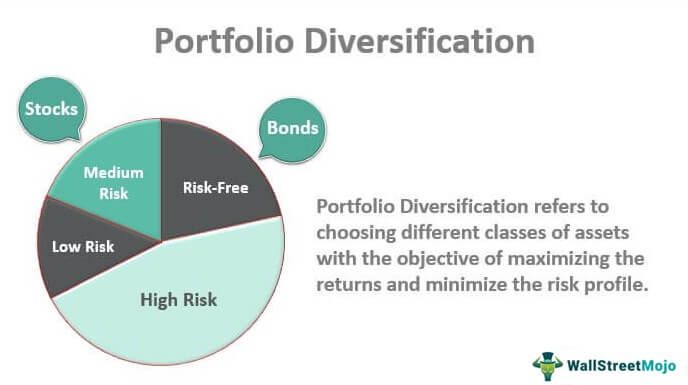

Diversification is good read crucial because it helps you increase your returns while decreasing your risk.

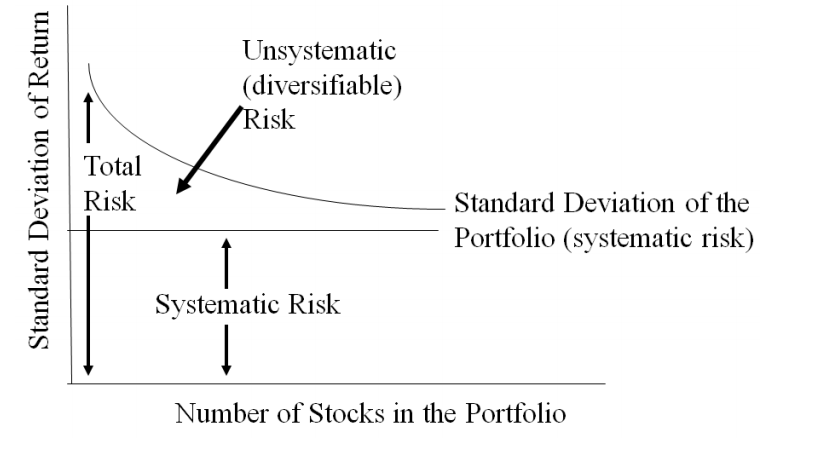

. Despite the widespread criticism from academia as well as practitioners the capital asset pricing model CAPM remains the most prevalent approach for estimating the cost of equity. Diversification is the process of mixing different assets within a portfolio to ensure that unsystematic risk is smoothed out. The screener uses growth in free cash flow and explosive EPS growth.

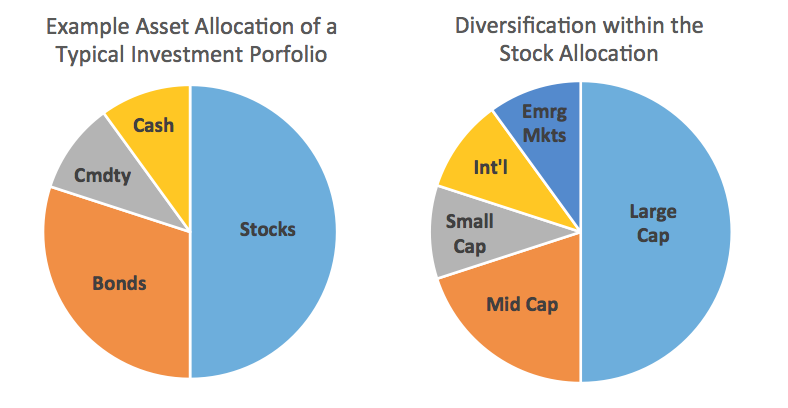

These funds help you maintain diversification in your portfolio by spreading your 401k money across multiple asset classes including large-company stocks small-company stocks emerging-markets stocks real estate stocks and bonds. Portfolio variance is a statistical value that assesses the degree of dispersion of the returns of a portfolio. Diversification is key to success when building a good investment portfolio.

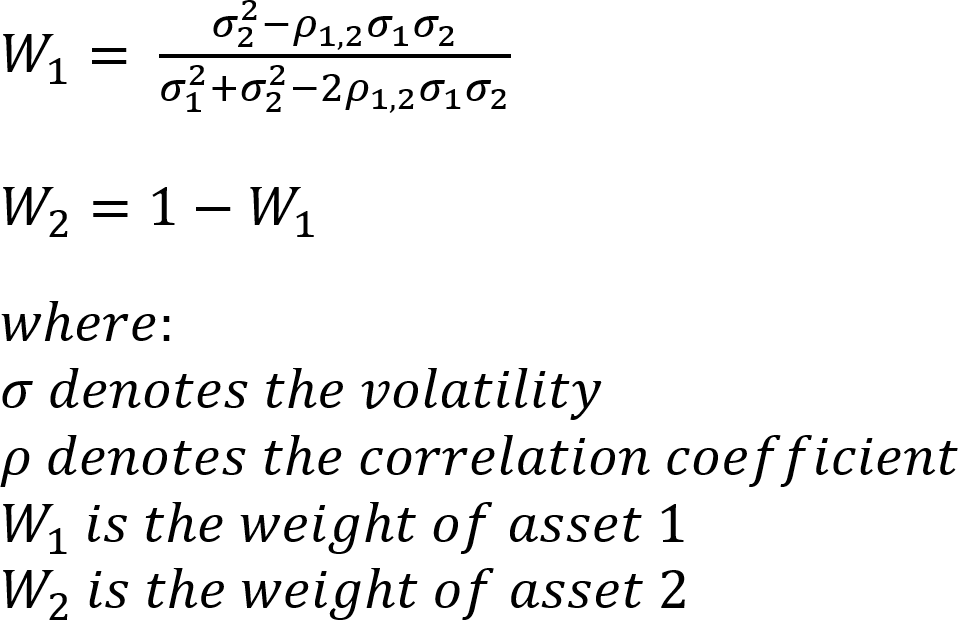

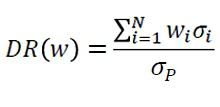

While variance and standard deviation of a portfolio are calculated using a complex formula which includes mutual correlations of returns on individual investments beta. Combining this with Joel Greenblatts ROC and Earnings Yield formulas the Magic Formula we have a selection of. Roll a pair of fair dice many times say 100 times or more and the result.

The general rule of portfolio diversification is the selection of assets with a low or negative correlation between each other. R1205C For many companies innovation is a sprawling collection of initiatives energetic but uncoordinated and managed with vacillating strategies. A diversified portfolio should be diversified at two levels.

Or equally diversification helps you increase your return without necessarily increasing your risk significantly. The CAPM links the expected return on securities to their sensitivity to the broader market typically with the SP 500 serving as the proxy for market returns. How to Decide If Investing in a.

Cost of Equity Formula. Before Markowitz portfolio theory risk return concepts are handled by the investors loosely. In this case the negative performance of a given assetsecurity within the portfolio is balanced out by the positive performance of other assets within the portfolio.

How to Invest When You Are in Your 20s and 30s. For steady above-average returns. In the end youll be making a very personal choice.

LST Beat the Market Growth Portfolio. Modern portfolio theory MPT is a theory on how risk-averse investors can construct portfolios to optimize or maximize expected return based on a given level of. Formula for Portfolio Variance.

If µ b is the acceptable baseline expected rate of return then in the Markowitz theory an opti-mal portfolio is any portfolio solving the following quadratic program. Will be a good indicator only if the portfolio under consideration is a well-diversified portfolio because under diversification may lead to underestimation of the portfolios riskiness as some idiosyncratic risk Idiosyncratic Risk. If a test question asks for the standard deviation then you will need to take the square root of the variance calculation.

Portfolio beta is a measure of the overall systematic risk of a portfolio of investments. NT is a set of weights associated with a portfolio then the rate of return of this portfolio r P n i1 r iw i is also a random variable with mean mTw and variance wTΣw. Markowitz Portfolio Theory deals with the risk and return of portfolio of investments.

He pointed out the way in. Modern Portfolio Theory - MPT. Example The following information about a two stock portfolio is available.

It is a formalization and extension of diversification in investing the idea that owning different kinds of financial assets is less risky than owning only one type. The Liberated Stock Trader Beat the Market Screener seeks to select stocks with a significant chance of beating the SP500 returns. It is an important concept in modern investment theory.

It equals the weighted-average of the beta coefficient of all the individual stocks in a portfolio. An investment portfolio stores all the assets you own across various accounts. Keep in mind that this is the calculation for portfolio variance.

Percentage values can be used in this formula for the variances instead of decimals. Now the beauty of the formula for portfolio risk is that we can actually see how these three factors come into play. Toss a fair coin many times say 100 times or more and you will get a balanced normal distribution of heads and tails.

The investors knew that diversification is best for making investments but Markowitz formally built the quantified concept of diversification. Modern portfolio theory MPT or mean-variance analysis is a mathematical framework for assembling a portfolio of assets such that the expected return is maximized for a given level of risk. Written by Arielle OShea Reviewed by Michael Randall.

Here we discuss the formula to calculate M squared measure along with examples advantages disadvantages.

Portfolio Diversification How To Diversify Your Investment Portfolio

Asset Allocation And Diversification Chartschool

Finance Portfolio Variance Explanation For Equation Investments By Zvi Bodie Quantitative Finance Stack Exchange

Business Banking Management Marketing Sales Risk Management In Banking The Effect Of Diversification On Portfolio Value

Business Banking Management Marketing Sales Risk Management In Banking The Effect Of Diversification On Portfolio Value

How Many Stocks Make Up A Well Diversified Portfolio Seeking Alpha

Solactive Diversification The Power Of Bonds

Calculating Expected Portfolio Returns And Portfolio Variances Youtube

:max_bytes(150000):strip_icc()/ModernPortfolioTheory1_2-8e6110a86b02462c89b401a46ad2118f.png)

Modern Portfolio Theory Why It S Still Hip

Time Diversification Redux Research Affiliates

Portfolio Returns And Risks Covariance And The Coefficient Of Correlation

Diversification Of Portfolios Matlab Simulink Example

The Portfolio Diversification Effect Youtube

Modern Portfolio Theory 2 0 The Most Diversified Portfolio Seeking Alpha

/ModernPortfolioTheory1_2-8e6110a86b02462c89b401a46ad2118f.png)

Modern Portfolio Theory Why It S Still Hip

Investment Analysis And Portfolio Management Lecture 3 Gareth Myles Ppt Download

Standard Deviation And Variance Of A Portfolio Finance Train